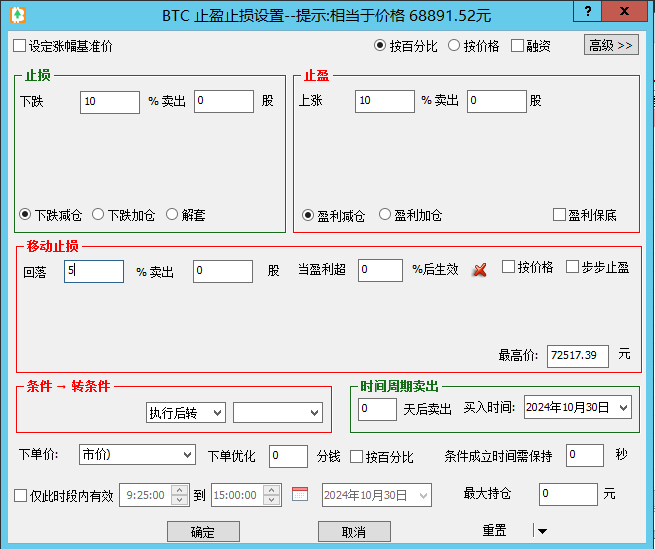

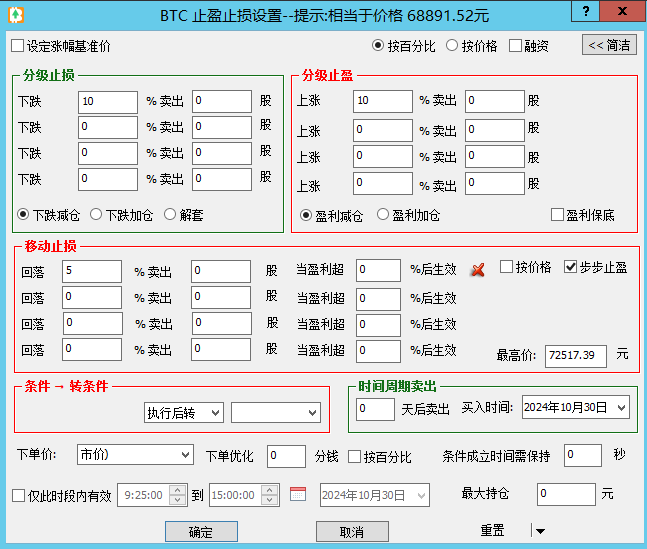

1. Fixed Take Profit & Stop Loss

After connecting your Binance API, follow these steps to set up fixed TP/SL:

- Double-click on a position entry in the main interface to open settings

- Select TP/SL mode (by percentage or by price)

- Configure specific take profit and stop loss parameters

1.1 Price Basis Settings

The system offers two price basis options:

- Historical Cost Price: Uses cost price calculated from historical trade records by default

- Custom Reference Price: Allows manual setting of the calculation reference price

Note: After multiple trading cycles of the same trading pair, historical cost price may vary significantly. Using a custom reference price is recommended.

2. Trailing Stop

Trailing stop (also known as moving stop or tracking stop) is a dynamic stop loss method that protects profits while allowing for potential further gains.

2.1 Basic Principles

- System tracks the highest price in real-time

- Triggers sell order when price drops below set percentage from the peak

- Peak price automatically updates with new highs

Peak Price Details

- Peak price tracking starts when conditions are set

- Software must remain running and connected

- Peak price can be manually adjusted

- View recorded peak price in the "Drawdown/Rebound" column on main interface

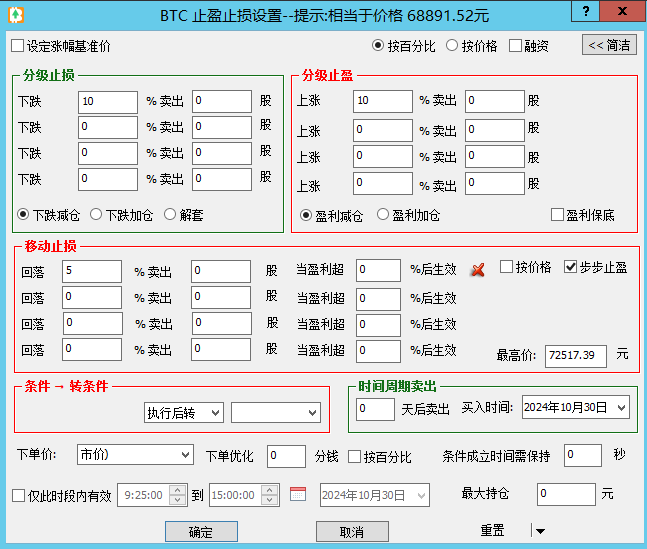

3. Batch Profit Taking

Click the "Advanced" button to set up batch profit-taking strategies:

3.1 Batch Settings

- Configure up to 4 profit-taking levels

- For each level, set:

- Trigger price or percentage

- Sell quantity

- Execution conditions

4. Combined Strategies

4.1 Step-by-Step Profit Taking

Dynamic profit-taking strategy combined with trailing stop:

- At 5% profit: Set 2% trailing stop

- At 10% profit: Set 4% trailing stop

- At 20% profit: Set 8% trailing stop

- At 30% profit: Set 10% trailing stop

4.2 Time-Based Stop Loss

Configure time-based stop loss strategies:

- Set trading time period (default 9:25:00 to 15:00:00)

- Set maximum position holding days

- Automatic position closure at expiration

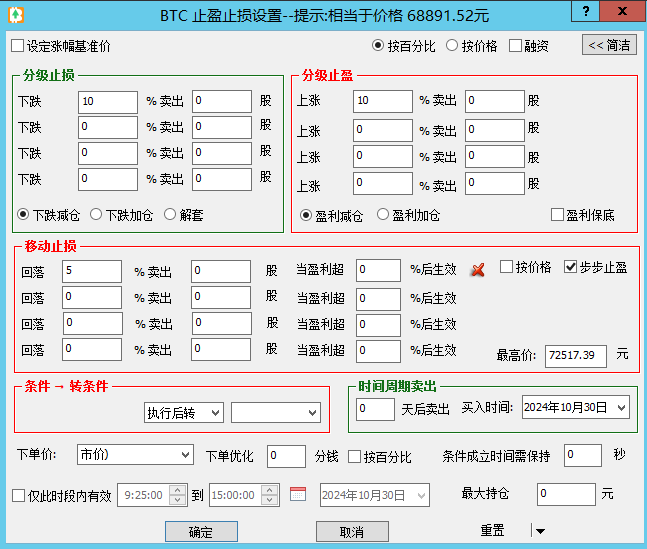

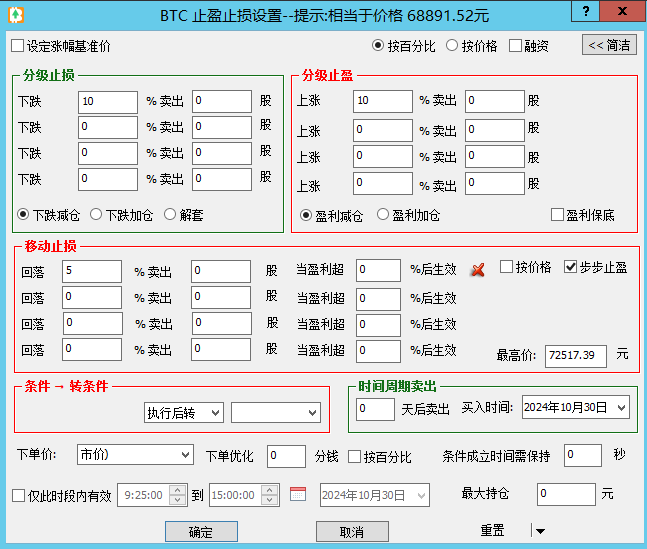

5. Execution Price Settings

5.1 Price Types

- Market Order: Execute at current market price

- Limit Order: Execute at specified price

- Conditional Order: Execute at trigger condition price

5.2 Price Optimization

- Fixed Amount Optimization: Add/subtract from best bid/ask price

- Percentage Optimization: Add/subtract percentage from last price

- Optimization values can be negative (for limit orders)

Price Optimization Notes:

- Fixed amount optimization based on best bid/ask price

- Percentage optimization based on last price

- Negative optimization may delay execution

Important Notes:

- TP/SL conditions won't execute repeatedly once triggered

- Conditions must be reset for repeated execution

- Regularly review and adjust TP/SL settings

- Keep software running when using time-based stop loss