1. Breakout Trading Setup

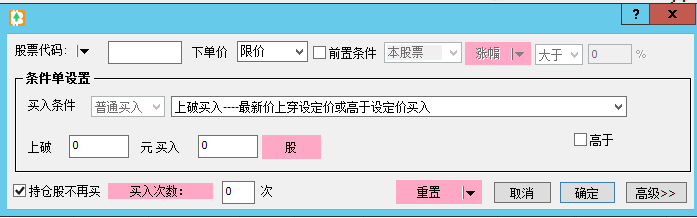

Price breakout trading includes two methods: upward breakout buy and downward breakout buy:

1.1 Upward Breakout Buy

- Executes buy orders when price breaks above or crosses the specified price level

- Allows configuration of order size and frequency limits

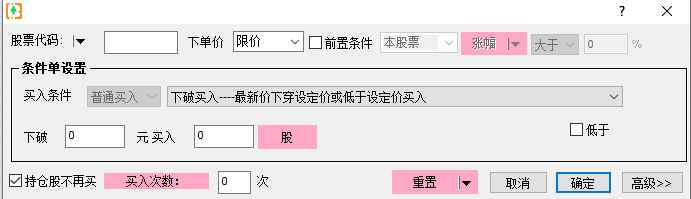

1.2 Downward Breakout Buy

- Executes buy orders when price breaks below or crosses the specified price level

- Ideal for accumulating positions during price pullbacks

- Includes customizable order size and frequency limits

Parameter Guide:

- "Breakout Price": Target price level that triggers the buy order

- "Buy Amount": Order size for each triggered transaction

- "Buy Frequency": Maximum number of executions (0 for unlimited)

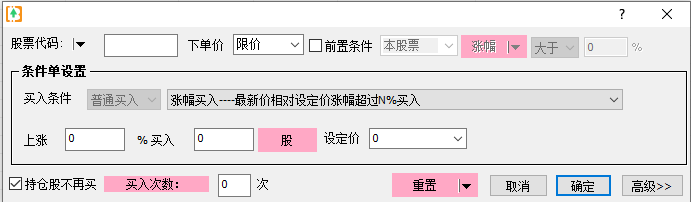

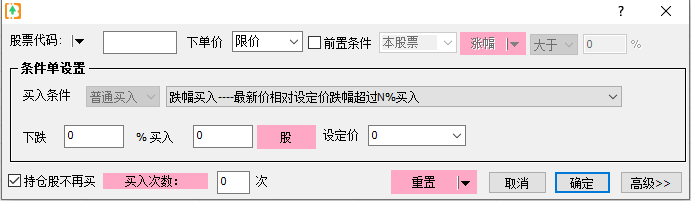

2. Retracement Trading Setup

Retracement trading triggers orders based on price percentage movements:

2.1 Upward Percentage Buy

- Set percentage increase relative to the base price

- Executes buy orders when price increases beyond the specified percentage

- Option to set a reference price as calculation basis

2.2 Downward Percentage Buy

- Set percentage decrease relative to the base price

- Executes buy orders when price decreases beyond the specified percentage

- Commonly used in bottom-fishing strategies

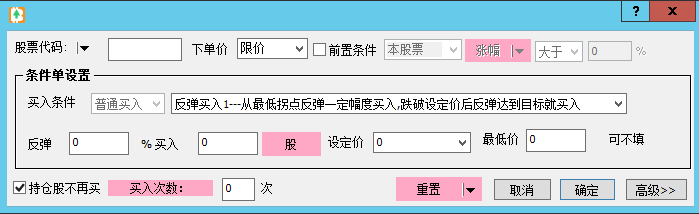

2.3 Bounce Buy

- Configure retracement percentage and target price

- Executes buy orders after price bounces specified percentage from lowest point

- Option to set minimum price threshold (reference price)

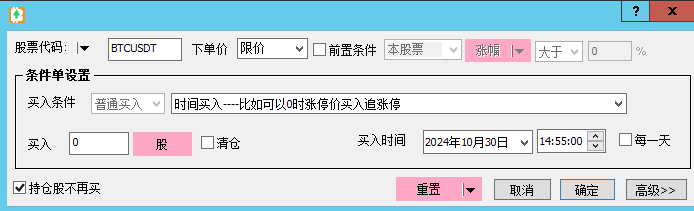

3. Time-Based Trading

Execute trades based on specific time points or intervals:

3.1 Scheduled Buy

- Set specific time points for buy execution

- Automatically executes orders at scheduled times

- Option for daily repetition

Time Settings Guide:

- Time precision to the minute

- Enable "Daily" option for recurring execution

- Ensure software remains running at scheduled times

4. General Parameter Settings

4.1 Parameter Description

| Parameter | Description |

|---|---|

| Buy Amount | Order size for each condition trigger |

| Buy Frequency | Maximum trigger occurrences (0 for unlimited) |

| Reference Price | Base price for calculations |

4.2 Important Notes

- Verify all conditional order parameters before execution

- Test strategies with small amounts initially

- Manual reset required for re-triggering conditional orders

- Ensure sufficient account balance for order execution