1. Strategy Introduction

Range trading (also known as grid trading) is an automated trading strategy that does not require predicting market direction. Both intraday charts and long-term candlestick patterns show that volatility is a primary market characteristic, and grid trading takes advantage of this feature to generate profits.

1.1 Advantages of the Strategy

- No need to forecast market trends

- No need to study fundamentals or news

- Automated high-sell low-buy to gain price differentials

- Suitable for most traders

- Can help generate additional income while holding quality assets

Usage Recommendations:

- Select trading pairs with good liquidity and moderate volatility

- Set reasonable trading ranges and grid spacing

- Be patient and allow the strategy to profit in a volatile market

- Regularly review and optimize strategy parameters

1.2 Applicable Scenarios

- Market oscillation phase: Prices fluctuate within a certain range

- Bottom building phase: Reduce costs through incremental buying

- High position reduction phase: Increase profits through incremental selling

- Intraday trading: Profit from intraday price fluctuations

2. Creating a Grid Trading Strategy

There are two ways to create a grid trading strategy:

2.1 Direct Creation

- Click the "Range Trading" button on the main interface

- Configure parameters in the pop-up settings window

2.2 Create from Holdings

- Right-click on the trading pair in the holdings list

- Select "Add to Range Trading Strategy"

- The system will automatically fill in the relevant parameters for the current holdings

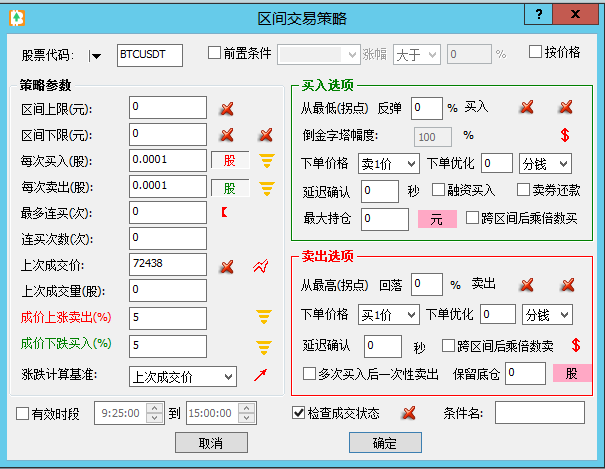

3. Parameter Settings

3.1 Range Parameters

| Parameter Name | Description |

|---|---|

| Upper Limit (Yuan) |

|

| Lower Limit (Yuan) |

|

| Buy Amount per Trigger |

|

| Sell Amount per Trigger |

|

3.2 Trading Condition Parameters

| Parameter Name | Description |

|---|---|

| Max Consecutive Buys |

|

| Consecutive Buy Count |

|

| Last Transaction Price |

|

| Last Transaction Volume |

|

| Price Increase Sell (%) |

|

| Price Decrease Buy (%) |

|

3.3 Pivot Point Parameters

| Parameter Name | Description |

|---|---|

| Lowest (Pivot) |

|

| Lowest (Pivot) Rebound Percentage |

|

| Highest (Pivot) |

|

| Highest (Pivot) Drop Percentage |

|

| Delay Confirmation Time |

|

3.4 Advanced Options

| Parameter Name | Description |

|---|---|

| Multiplier Buy After Crossing Ranges |

|

| Multiplier Sell After Crossing Ranges |

|

| Sell All After Multiple Buys |

|

| Check Transaction Status |

|

Advanced Options Usage Recommendations:

- It is recommended to become familiar with basic functions before using advanced options

- When using leveraged trading, be cautious of controlling capital risk

- Enabling transaction status checks can enhance strategy stability

3.5 Grid Matching Mode

Grid matching is an important advanced feature controlled by the red arrow button:

- The pressed state of the red arrow indicates that pairing grid prices is enabled

- Sales following consecutive purchases will match the previous purchase prices

- Ensures that each trade meets the expected profit target

| Function Description | Working Principle |

|---|---|

| Sell Matching |

|

| Buy Matching |

|

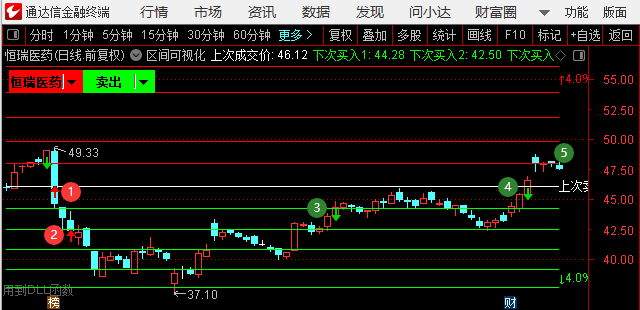

Example showing the difference between grid matching and non-matching

Example Explanation:

- After two consecutive buys at points ①②, the stock price continues to drop

- Operations are paused due to risk control or network disconnection

- At point ③, the price rises by 4%, executing the first sell

- When reaching point ④:

- If grid matching is not enabled: A sell is executed since the relative increase from ③ reaches 4%

- If grid matching is enabled: The comparison is made with the historical purchase price at ①, which does not meet the 4% increase, so no sell is executed

- It will only sell when the price continues to rise to point ⑤, reaching a 4% increase relative to ①

Advantages of Grid Matching:

- Ensures that each sale meets the expected profit target

- Avoids premature selling during minor fluctuations

- Increases the stability of the strategy's profitability

- Especially suitable for oscillating upward trends

- Requires the Premium version or higher for support

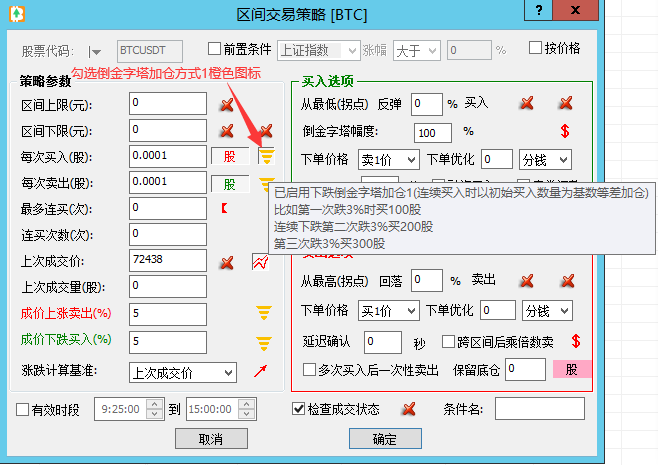

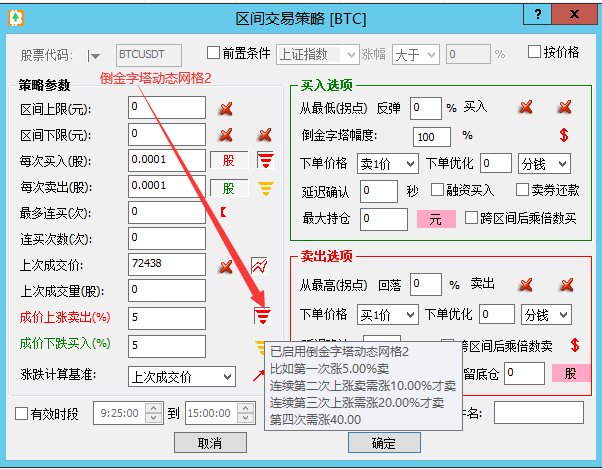

3.6 Inverse Pyramid Strategy Settings

3.6.1 Inverse Pyramid for Buy/Sell Quantities

Both buying and selling quantities support dynamic adjustments in an inverse pyramid manner:

| Direction | Description |

|---|---|

| Buy Quantity Inverse Pyramid |

|

| Sell Quantity Inverse Pyramid |

|

3.6.2 Inverse Pyramid for Buy/Sell Price Intervals

Both buy and sell trigger intervals support dynamic adjustments in an inverse pyramid manner:

| Direction | Description |

|---|---|

| Buy Interval Inverse Pyramid |

|

| Sell Interval Inverse Pyramid |

|

Characteristics of Inverted Pyramid Strategy:

- Quantity Inverted Pyramid:

- Buying Direction: Suitable for gradually increasing position during a downward trend

- Selling Direction: Suitable for gradually increasing profit-taking intensity during an upward trend

- Can flexibly respond to trending markets

- Interval Inverted Pyramid:

- Buying Direction: Avoid exhausting funds too early during a unilateral decline

- Selling Direction: Avoid clearing positions too early during a strong rally

- Can dynamically adjust grid size to adapt to different market conditions

- Combination Usage Recommendations:

- Can use both quantity and interval inverted pyramids simultaneously

- Select appropriate increment based on market conditions and capital situation

- Pay attention to risk control to avoid excessive position buildup or holding

3.7 Other Important Settings

| Option Name | Description |

|---|---|

| Use of Transaction Price |

|

| Buy Option Check |

|

| Sell Option Check |

|

4. Statistics and Analysis

4.1 Interval Profit Statistics

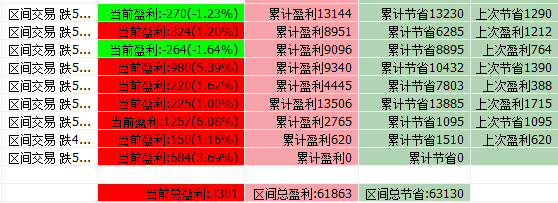

The software provides complete grid trading statistics to help you analyze strategy effectiveness:

Interval Statistics List

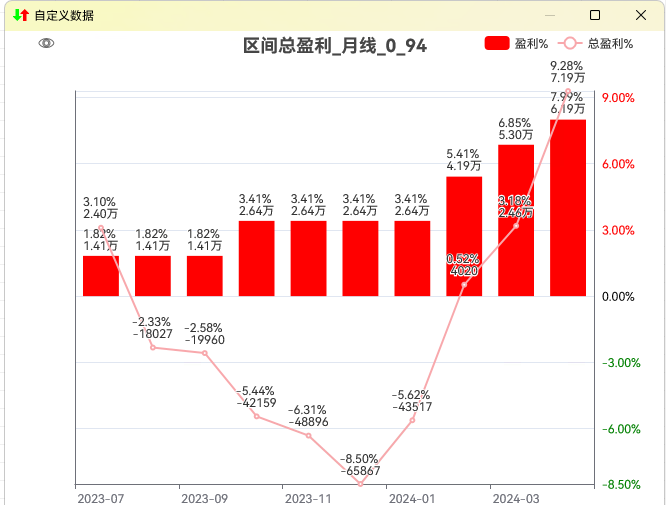

Monthly Total Profit Statistics Chart

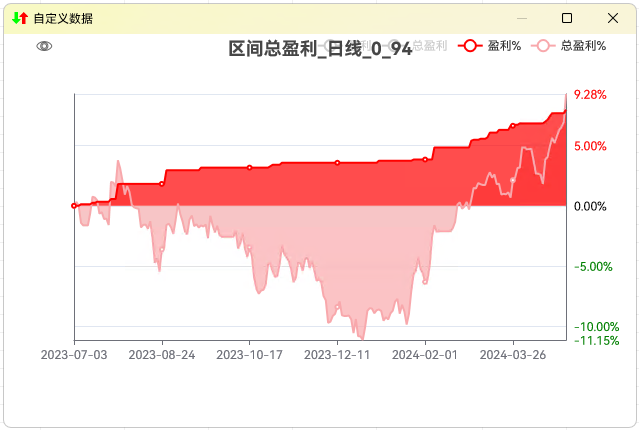

Total Profit Statistics Chart

| Statistical Indicator | Description |

|---|---|

| Interval Profit |

|

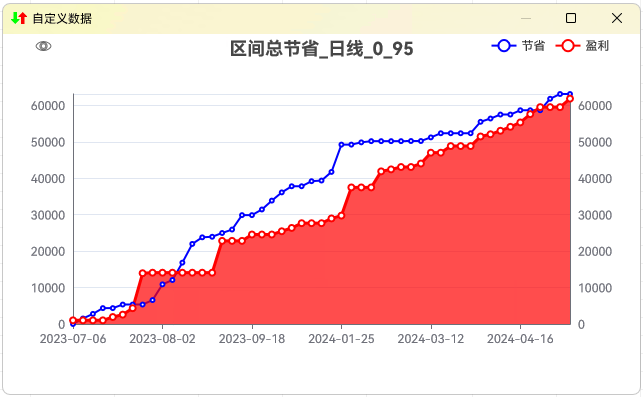

| Interval Savings |

|

4.2 Interval Savings Statistics

The blue line represents total savings for the interval, while the red line represents total profit for the interval.

Significance of Interval Savings Statistics:

- Reflects the effectiveness of strategy in building positions during a decline

- Helps evaluate the effectiveness of cost control

- The blue line above the red line indicates a choppy downward market

- Can help determine if strategy parameters are reasonable

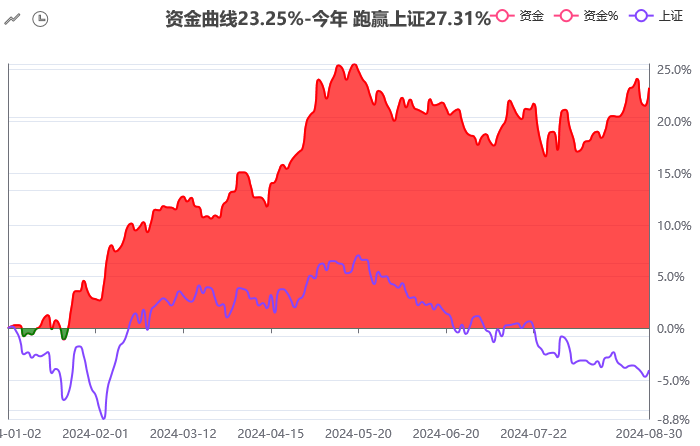

4.3 Capital Curve Analysis

The red line represents strategy returns, while the purple line represents benchmark returns (e.g., Shanghai Composite Index).

| Analysis Dimension | Description |

|---|---|

| Return Comparison |

|

| Drawdown Analysis |

|

4.4 Data Record Viewing

Detailed trading records and statistical data can be viewed.

Viewing Method:

- Click the dropdown arrow next to the interval trading button.

- Select the type of statistical data to view:

- Total interval profit

- Total interval savings

- Monthly total profit

- Interval trading records

- Right-clicking on the capital curve can also show relevant statistics.

Suggestions for Using Statistical Functions:

- Regularly check statistical data to assess strategy effectiveness

- Compare performance over different periods to optimize parameters

- Enhance confidence in strategy execution through statistical data

- Be aware of the impact of the overall market environment